Have you ever thought about using your money twice?

Most rich people buy things like houses or pieces of companies. Then, they borrow money and use those things they bought as a promise to pay back the loan. They can keep the things they bought and get more money to spend or save. But this can be dangerous if you’re not careful. Stack is an app that lets you do this safely. We’ll talk about how anyone can use Stack to be smart with their money.

What is Stack?

Stack is an ai money tool. It lets you use your money to pay bills and save at the same time.

How? Let’s look at an example:

Meet Miguel: A Stacker

Miguel has a $25 Netflix bill. Before he pays it, he goes to Stack and adds $10 extra. So now, his total is $35. You can try this at http://app.stackit.ai.

Here’s what Miguel does:

- He puts the whole $35 in Stack.

- Stack takes Miguel’s $35, and then they let him borrow $25 more.

- Miguel gets that $25 right away.

Investing begins

Stack takes at least $32 of Miguel’s $35 and invests it equally into Bitcoin and Ethereum. So Miguel pays his Netflix bill and saves money at the same time. It’s like magic, but really, it’s just being smart with money.

How Does the Loan Work?

The loan in Stack is a special kind of loan where you have more money than you’re borrowing. The best part? There are no credit checks, and it doesn’t connect to your credit at all. You don’t have to pay it back every month as long as you have enough extra money (buffer) to cover it.

What if the Money Value Goes Down?

If that happens, Stack will sell just enough Bitcoin and Ethereum to keep your loan safe. You can also always pay off the loan or put in more money.

Why is This Smart?

This is a smart way to save money and use compound interest, which makes your money grow.

Here’s an example:

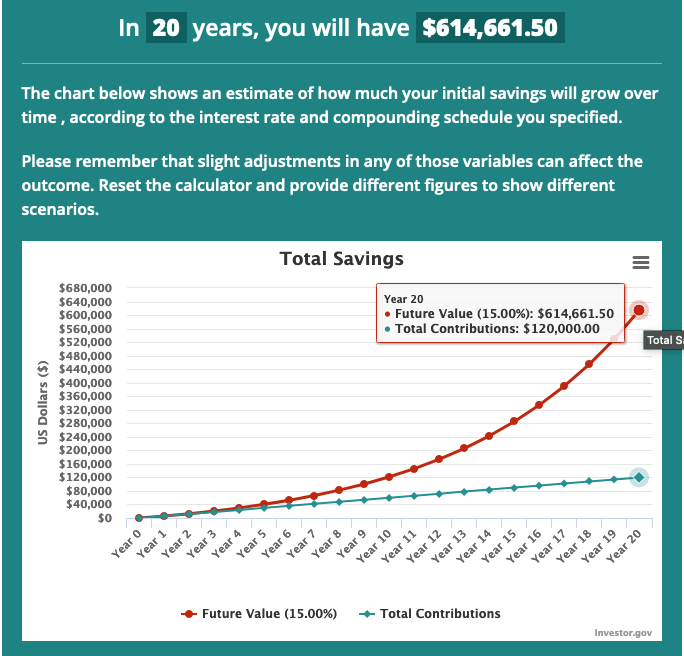

If you put $500 a month in for 20 years, and it grows by 15% a year, you’d have $614,661.50.

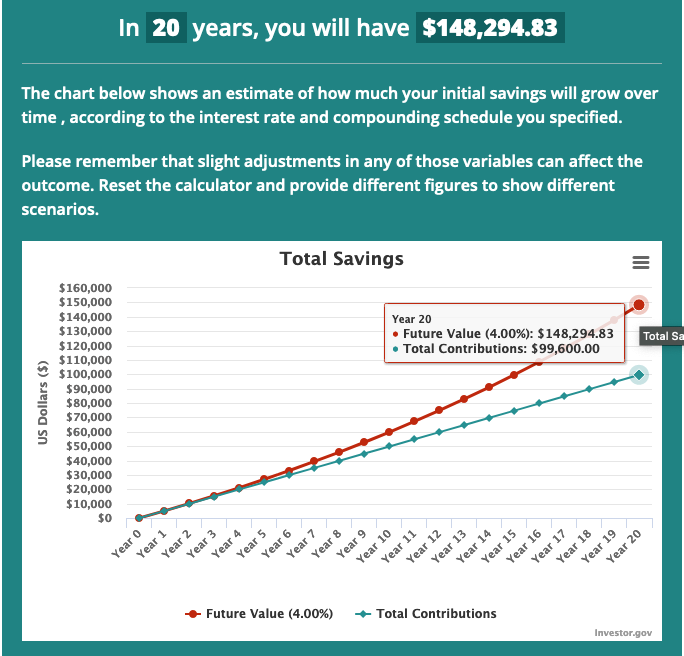

If you borrowed $415 a month to pay bills during that time with a 4% interest rate, you’d owe $148,294.83. But you’d still have $614,661.50 growing.

Check the compound interest calculator with your own numbers.

Rich people often do this, borrowing money instead of selling things that are growing in value.

Conclusion

Stack is a cool way to be smart with your money. You can borrow against your own money to spend it and save at the same time. You can make your money work twice as hard for you!

Want to try it?

If you want to use Stack, it can help you take charge of your money. Try it and see how it works for you!

Important Note: Remember, investing money can be risky. It might be a good idea to talk to someone who knows about money or do lots of research before you make large investing choices.